Life Insurance Policy

Life insurance is a type of insurance policy that pays out a sum of money to the beneficiaries listed in the policy in the event of the insured person’s death. The purpose of life insurance is to provide financial protection for the policyholder’s loved ones after their death.

Life insurance policies come in several forms, including term life insurance, whole life insurance, and universal life insurance. Term life insurance provides coverage for a specific period, usually 10, 20, or 30 years. Whole life insurance and universal life insurance are types of permanent life insurance that provide coverage for the policyholder’s entire lifetime, as long as we pay the premiums.

The amount of life insurance coverage needed depends on various factors, such as the policyholder’s age, income, debts, and dependents. It’s important to carefully consider the coverage amount and the type of policy that best fits your needs and budget.

Life insurance premiums are based on several factors, including the policyholder’s age, health, and lifestyle. Applicants may be required to undergo a medical exam before being approved for a policy.

Life insurance can provide peace of mind knowing that loved ones will be financially protected after the policyholder’s death. It can help cover expenses such as funeral costs, outstanding debts, and ongoing living expenses.

Types of Life Insurance

There are several types of life insurance policies, including:

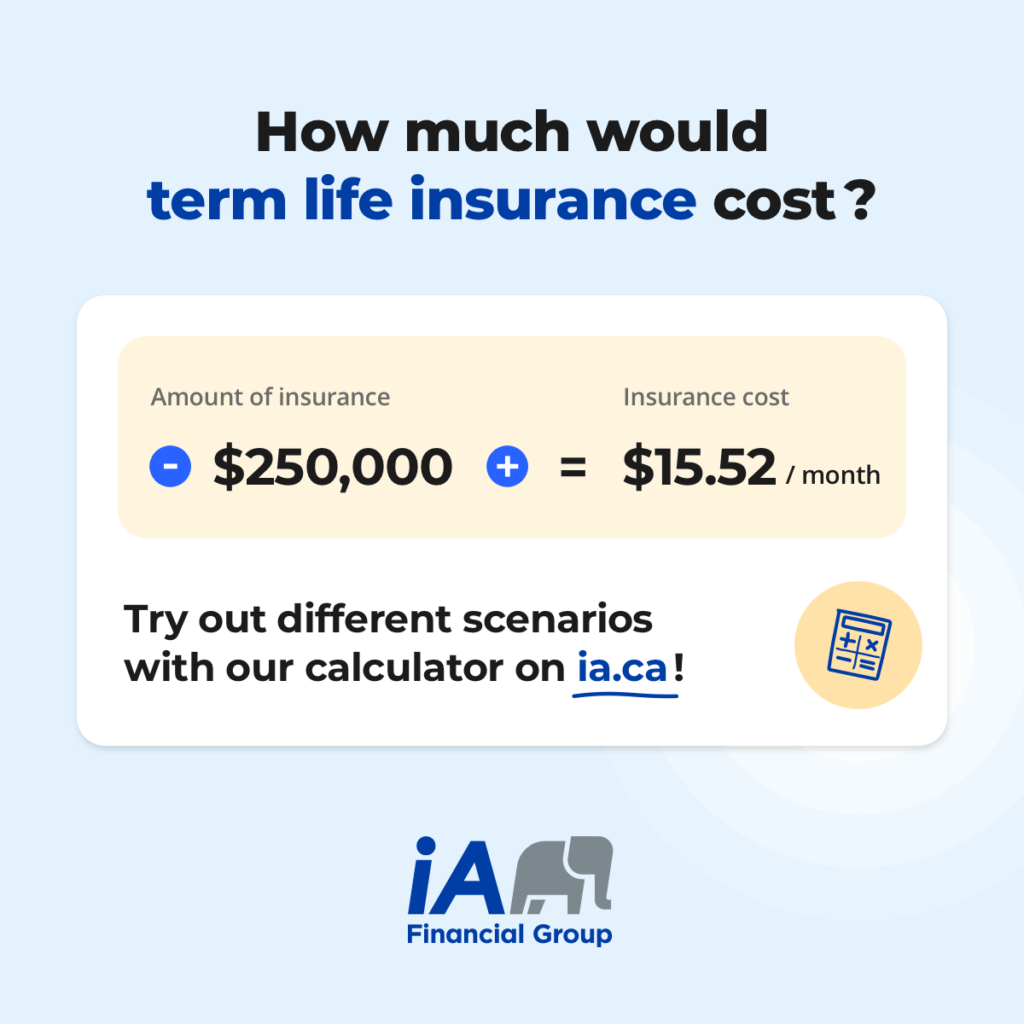

Term Life Insurance: This is the simplest and most affordable type of life insurance. It provides coverage for a specified term or period, usually ranging from 1 to 30 years. If the policyholder dies during the term, they pay the death benefit to the beneficiary. If the policy expires before the policyholder dies, there is no payout.

Whole Life Insurance: This is a type of permanent life insurance that provides coverage for the policyholder’s entire lifetime. It also includes a savings component, called cash value, which grows over time and can borrow against or withdraw from.

Universal Life Insurance: This is another type of permanent life insurance that provides flexibility in premium payments and death benefits. The policyholder can adjust the premium payments and death benefit as needed, as long as the policy has sufficient cash value.

Variable Life Insurance: This is a type of permanent life insurance that allows the policyholder to invest the cash value in various investment options, such as stocks and bonds. The death benefit and cash value can fluctuate based on performing the investments.

Guaranteed Issue Life Insurance: This is a type of life insurance that does not require a medical exam or a health questionnaire. They designed it for people who may have difficulty getting approved for traditional life insurance because of health issues.

Accidental Death and Dismemberment Insurance: This is a type of insurance that pays a benefit if the policyholder dies or is dismembered as a result of an accident. It is often sold as a rider to a traditional life insurance policy.

It’s important to carefully consider the coverage amount and the type of policy that best fits your needs and budget. Consulting with a financial advisor or insurance agent can help you make an informed decision.

Lets Work Together to Secure Your Life.

Reach out with the contact information below, or send a message using the form.